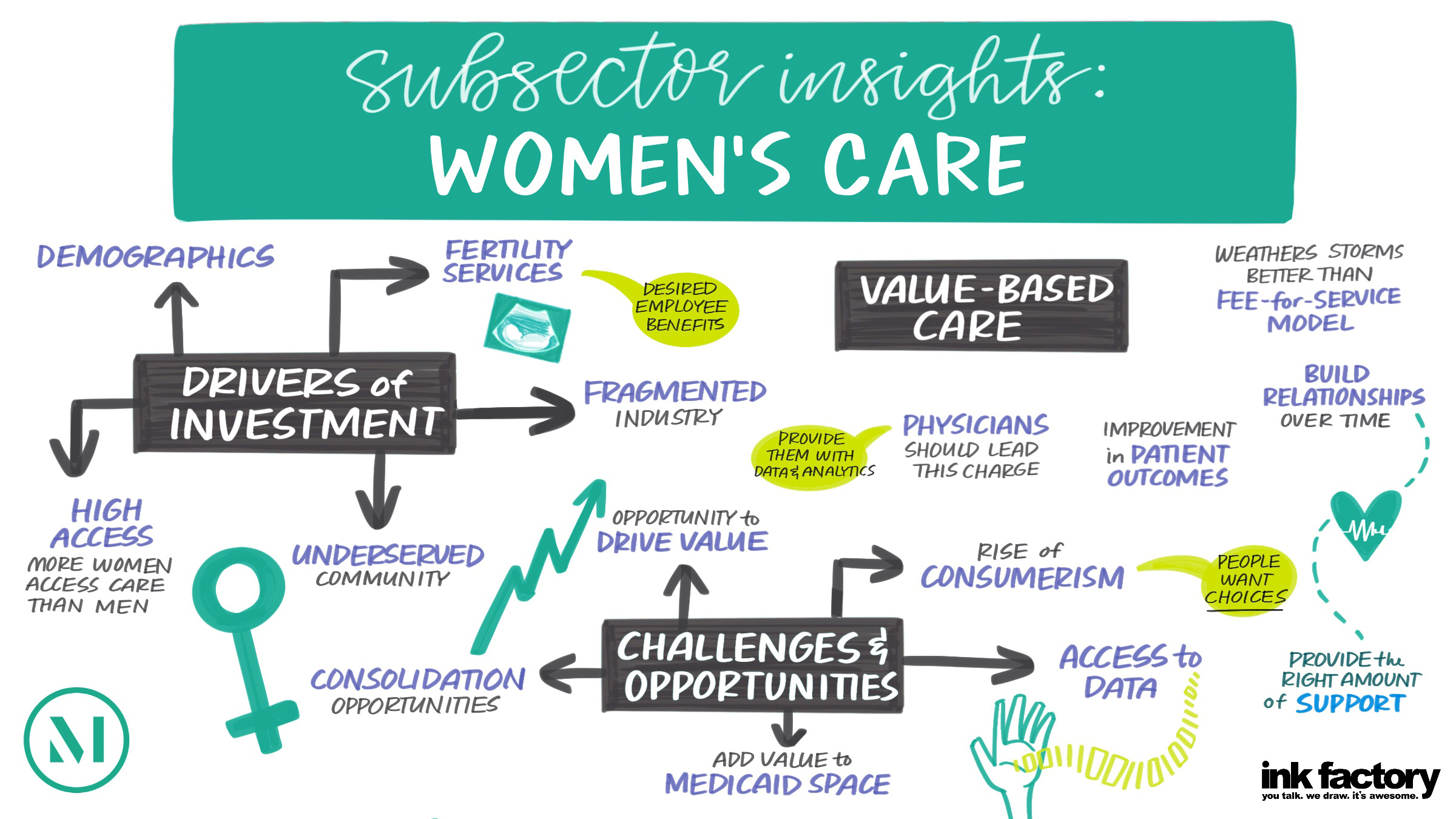

The field of women’s care offers investors several excellent entry points for innovation and growth. McDermott partner Joshua Spielman moderated this conversation featuring insights from Michael Chang, partner at BC Partners; Robert LaGalia, president and chief executive officer of Unified Women’s Healthcare; and Uttara Marti, managing director at Evercore.

Access the PDF here.

Women’s health continues to be one of the most fragmented sectors of the healthcare industry, which means that there are ample opportunities for new entrants and existing platforms to innovate, integrate and improve the delivery of care in this space.

Women’s care providers have an opportunity to expand their core OB/GYN and fertility focus. Providing additional wrap-around services can drive incremental value.

Women’s health is uniquely able to take advantage of value-based care arrangements, but key obstacles must be overcome first, including scale, provider buy-in and access to the necessary data.

Fertility services remain a strong driver in the women’s health space. More and more, employers are providing fertility coverage and benefits, helping to drive access and volume in this sector.

To catch up on all of the sessions from the HPE Miami 2021 Conference, please click here.

read more

Subscribe

Subscribe