Our panel included a discussion on what is ahead for 2021 and how the challenges of COVID-19 will lead to lasting changes for hospitals and health systems, with Lloyd Dean (CEO, CommonSpirit), Melinda Estes, MD (President and CEO, St. Luke’s Health System) and Jaewon Ryu, MD (President and CEO, Geisinger). These top healthcare leaders discussed the short- and long-term impact of COVID-19 on hospitals and health systems and their strategic business priorities in 2021 and beyond with moderator Kerrin Slattery (Partner, McDermott Will & Emery).

Below are the top takeaways for McDermott Will & Emery and EY during the 2021 J.P. Morgan Healthcare Conference: Hospital and Health System CEO Panel: Strategic Business Priorities, click here to access the full webinar.

Access the PDF here.

HOW 2020 PRIORITIES WILL SUSTAIN AND PROVE HELPFUL IN 2021 AND BEYOND

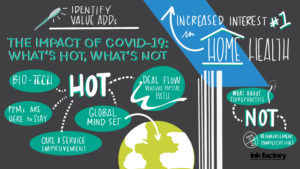

For hospitals and health systems, 2020 began and was primarily focused on issues like cost and payment models, Medicaid expansion and the wellbeing of clinical providers, including physicians, where statistics cite 40% are burned out. SinceCOVID-19, hospitals instantly pivoted to healing their communities and their staff, as well as rejuvenating the delivery system. “I was very pleased to chair a task force on COVID-19 pathways to recovery that produced a dynamic document that [...]

Continue Reading

read more

Subscribe

Subscribe