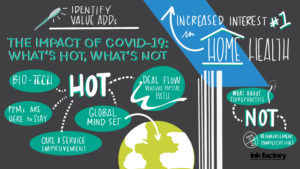

In the wake of COVID-19 some health sectors have emerged as hot while others are troubled. Our panel of active investors discussed where the dollars are going and offered insights on why in relation to the events of 2020. McDermott partner Jerry Sokol moderated this dynamic panel featuring Paige Daly, partner at Harvest Partners; Chris Gordon, global head of healthcare and co-head of North America private equity at Bain Capital; Geoff Lieberthal, partner at Two Sigma Impact; and Rob Wolfson, executive managing director and head of H.I.G. Advantage Fund and U.S. Healthcare.

Below are the top takeaways for HPE New York 2020 half day session: The Impact of COVID-19: What’s Hot, What’s Not, click here to access the full webinar.

Access the PDF here.

COVID-19 has revealed weaknesses in the healthcare system and in healthcare delivery in particular. “One of the most fundamental things that we as healthcare investors all should be thinking about is investing in businesses that are making things better for the entire system—for patients, for providers and for payors,” Ms. Daly said. “That means we should be both raising quality and lowering costs.” These principles are driving some of the most exciting innovation today, particularly in payor services, physician practice management (PPM) and healthcare IT.

Healthcare IT generally and telemedicine specifically are areas of major investment. Dramatically accelerated patient and payor adoption of telehealth has created growth potential in new areas such as tele-dermatology. At the same time, increased interest can present a threat. “Let’s say you’re the market leader in an area of healthcare,” Mr. Lieberthal said. “Suddenly, your competitors might start picking off patients or experimenting with getting traction in your market through telehealth.”

Pharmaceutical services is a particularly hot sector. “Generally these businesses have done well and might even have had tailwinds during the pandemic,” Ms. Daly said. “Anything that gets drugs, vaccines or treatments to market faster is something that people are pretty excited about.”

According to Mr. Wolfson, PPMs are not only hot, they’re here to stay, While the recent resurgence in PPMs has seen winners and losers, the differentiator is whether it improves care for patients and improves providers’ ability to deliver better care.

Special purpose acquisition companies (SPACs) have become popular. “I think the big question is: Should they be, and are they here to stay?” Mr. Gordon said. For SPACs to have staying power, they will have to add value, rather than simply creating transactions for the sake of transactions, Mr. Wolfson agreed. “SPACs are a more efficient on-ramp in terms of financial visibility, ability to work with sellers, the amount of capital you can exchange and debt limits,” he said. “But there needs to be a value-add. Some of these … will not be happening in a year or certainly five years from now.”

To catch up on all of the webinars in our HPE New York 2020 series, please click here.