There has been increased interest by hospitals and health systems in creating innovation centers and making innovation center investments, which are helping to transform the healthcare landscape. As they enter this space, hospitals and health systems must first decide how to organize to capitalize on and commercialize innovation opportunities to get innovations into the routine of patient care.

There has been increased interest by hospitals and health systems in creating innovation centers and making innovation center investments, which are helping to transform the healthcare landscape. As they enter this space, hospitals and health systems must first decide how to organize to capitalize on and commercialize innovation opportunities to get innovations into the routine of patient care.

Joined by leaders from Health Innovation Strategies and Winter Street Ventures/Commonwealth Care Alliance, we discussed the fundamental types of investment structures from the health system perspective, including types of vehicles used by health systems, tips for aligning investment priorities with the health system mission, and collaborations with third parties to accelerate innovation.

Below are the top takeaways for Hospital and Health System Innovation Summit: Nuts And Bolts: How to Invest in Innovation, click here to access the full webinar.

Access the PDF here.

There are many options for structuring an innovation center and there is no one-size-fits-all model.

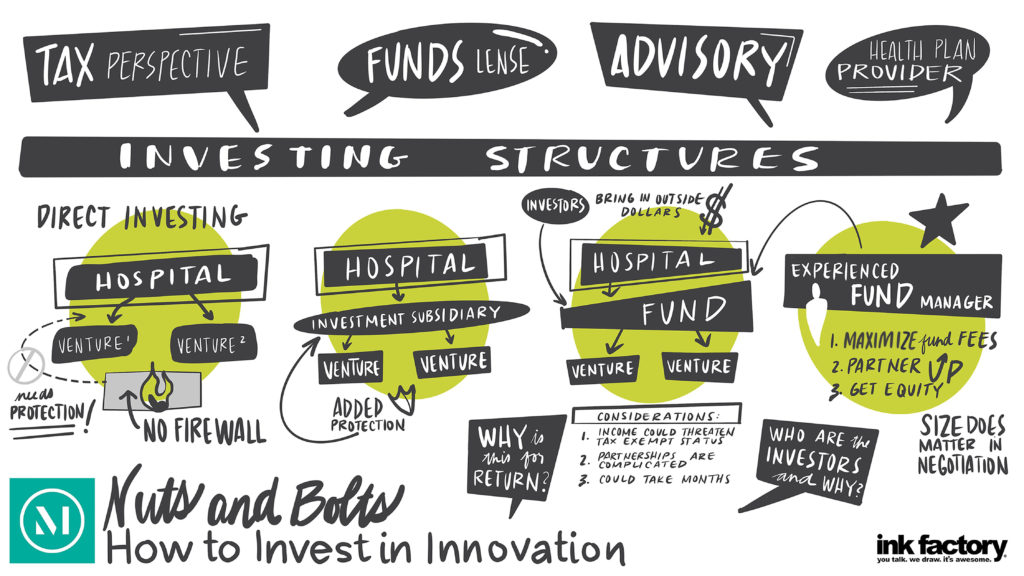

Innovation centers are often custom-built around the organization’s needs and with the input hospitals and health systems receive from their clinicians, board, patients, and community. Determining what innovation model to pursue involves weighing the amount of financial risk the entity will take on, the complexity of the venture, and the expertise available to guide the center’s development. To date, the most common innovation structures that have emerged are direct investing and direct investing through a subsidiary, which carries different legal and business implications.

Direct investing considerations

Hospitals and health systems may opt for direct investment to avoid the complexities of forming a separate entity. Direct investments allow hospitals and health systems to clearly define roles and responsibilities and have authority over investment decisions and funds. By directly investing, hospitals and health systems can directly integrate investments with clinical care and research operations. However, entities that adopt a direct investment model may be less insulated from tax, financial, litigation, and compliance risks.

Direct investing through subsidiary considerations

Direct investing through a subsidiary can help insulate the system from tax and litigation risks by more clearly establishing a firewall between clinical operations and research and the innovation investment, setting clear lines of authority and accountability, and streamlining the decision-making process of the investment function. This model can also create a vehicle to attract specialized expertise and co-investors, generate an entrepreneurial culture, and promote active involvement by internal inventors.

Forming a fund can “supercharge” an innovation center’s investment.

Formation of a “fund” is another option that can allow hospitals and health systems to have shared involvement in the innovation initiative. This approach carries many of the benefits of direct investing through a subsidiary, such as clear authority lines and streamlined decision-making. However, a system must weigh their goals in being a strategic investor against their obligations to the investors they partner with. At times, there may be tensions between strategic and financial returns.

There are also many opportunities to form a fund by partnering with existing fund managers who can bring experience to innovation pursuits.

Some systems are entrusting existing fund managers to manage investment initiatives. Systems have wide latitude to negotiate for a beneficial innovation structure. For example, as an anchor investor, hospitals and health systems may negotiate for preferential or participation in fund economics, such as reduced management fees and carried interest payable in connection with their investment in a fund. Systems may negotiate to receive a better “most favored nation” right so that the rights they receive are equal to or better than the rights received by other investors in the fund. Other opportunities for anchor investors include negotiating to receive equity in the sponsor’s management company, preferential co-investment rights, the right to serve on the fund’s Limited Partner Advisory Committees, consent rights over fundamental transactions, and more.

To catch up on all of the panels in our Hospital and Health System Innovation Summit, please click here.